Different Insurance In Usa

Different Insurance In Usa – The insurance sector consists of companies that offer risk management as insurance policies. One of the basic insurance concepts is that an aspect, insurance will get payments in the future uncertainty incident. Meanwhile, another party, insurance or insurance holder pays a minor premium to the carrier in exchange for this protection against this future deficiency.

As an industry, insurance growth is slow and safe for investors. This view is not as strong as the 1970s and 1980s, but it is usually true compared to other economic sectors.

Different Insurance In Usa

The insurance sector is mostly rooted in risk management. All written guidelines are analyzed with different risks that are considered, and the active study is provided to understand the statistical situation which is the best outcome. Based on the variants of statistical data and projections, insurance premiums have been adapted or the benefits are re -evaluated. In general, the premium amount for the premium amount paid in the insurance sector is the risk function associated with goods or freight.

When Does Health Insurance End After Leaving A Job?

In some cases, insurers will meet the banks of the bank product market. This practice is the most common in Europe known as “Bankartza”, but it is found a shoe in the United States.

One of the most interesting features of insurance companies is that it is mainly allowed to invest their clients money. This is similar to the banks, but investment is made to a greater extent. Sometimes called “float”.

The fleet occurs when one aspect raises money to another party and does not expect refund after a circumstance. This mechanism basically means that insurers have a positive capital cost. This separates private money cultural heritage, banks and mutual communities. For investors in stock insurers (or insurers in the mutual society, which means lower risk and stable returns.

Insurance plans are the main product in the sector. However, in recent decades have brought to business plans and years of pension content plans. It is located in direct carrier and other types of financial providers in these products. Many insurers now have their own brokers at home or in collaboration.

U.s. Census Bureau On X: “the Percentage Of People Without Health Insurance Coverage For The Entire 2017 Calendar Year Was 8.8%, Or 28.5 Million, Not Statistically Different From 2016 (8.8% Or 28.1

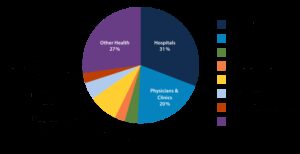

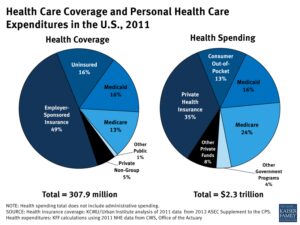

Not all insurers offer the same products or respond to the same basis as a customer base. There are accidents and health insurance among the largest categories of insurers; Merchandise and accident insurance; And financial guarantees. The most common types of personal insurance are cars, health, homeowners and life. Most people in the United States have at least one of these types of insurance, and the law requires car insurance.

Accident and health companies are probably the most popular. These include companies such as the United Party Health, Anthem, Aetna and AFLAC, designed to help those who are physically wrong.

Life insurers are mainly protected by guidelines that pay benefits to the death as a result of death in insurance recipients. Life insurance can be sold as a period, more expensive and more durable or permanent (usually life or universal life), it is very expensive, but it leads to lifelong components. Long -Term Disability representing insurance companies as insurance can also be sold if they are sick or disabled. Well -It was the insurance companies in life are the northwest mutual, saint employer, wisdom and William Penn.

Property companies and accidents ensure against injury without physical injury. This may include litigation, personal assets, cars and more. Major property and coincidence insurance are state farms, Nationwidean Allstate.

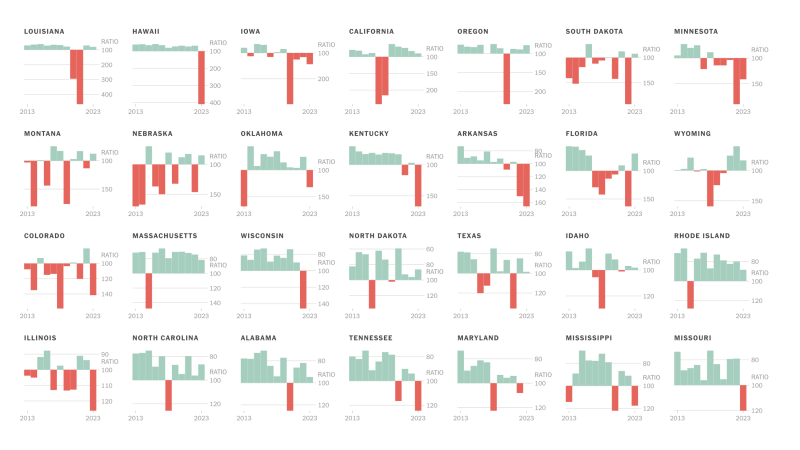

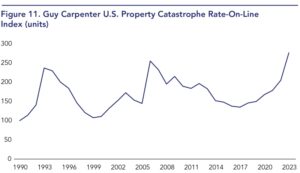

Disaster Risk And Rising Home Insurance Premiums

Companies need special types of insurance that protects specific risk types in the face of a particular business. For example, a street kitchen restaurant requires a policy that covers damage or damage to a fry. A car supplier does not depend on this type of risk, but it should cover any damage or damage that may occur in test drivers.

There is also a very specific need for insurance, such as kidnapping and rescue (K&R), medical medicine and professional liability insurance also known as Azerrors and omississ insurance.

Some companies reduce the risk of urin insurance. Insurance reinforcement companies to protect excess loss against excess loss of excess loss. There is a complete component of insurers, the Thamselvesssolvent tank to decorate avoidesvaultd, and regulators dictate for companies of a certain size and quality.

For example, an insurer can write too much hurricane -based assurance that shows low chances of a hurricane caused by a geographical area. If it happened to an incredible hurricane, there may be huge losses for the carrier. Without taking any risk to the board, insurers can leave the business in a natural disaster hit.

Life Vs. Health Insurance: Choosing What To Buy

Insurance companies are ranked in stock or each other according to the structure of the organization’s property. There are also some exceptions, such as the blue cross section of blue clothing and groups with different structures. However, equity and mutual society are far from the most important way of organizing themselves.

Astock Insurance Corporation is owned by its shareholders or shareholders, and the advantage is to take advantage of them. Import does not directly divide the company’s profits or losses. In order to operate as a corporation, an insurer must have a minimum capital and profit before receiving approval from the state regulator. Other conditions must also be fulfilled if the company’s shares were made public. Some well -known stock carriers are allstate, metlife and prudential.

The Mutual Society Insurance is a company that is the right to vote for those who are insurance for the “creditor for the board. In general, companies are managed and active (insurance reservations, profits, emergency funds) are made for insurance and receiving benefits .

The Directorate and the Board decided how much operating income is paid as dividends of insured individuals. Although it is not guaranteed, it is the company that has paid adivavers -even in difficult economic times. Gjensidige insurers are northwest in the United States, size protection, Penn reciprocity and Omaha reciprocity.

Understanding The Different Types Of Health Insurance In The Usa

According to March 2023, the UNA industry was raised from the Institute of Insurance Institute of the US Insurance in 2021 with a premium of $ 1.4 billion in the network.

Buying stocks from insurers can provide more benefits. Insurance companies are allocated in insurance payments. Investors can have the reliability and stability of this stable source of income. This cash flow is often resolved and is close to long -term agreements.

As customers and wallets of insurance products grow, insurers can see long -growth. Insurance protection conditions often increase as population and finance while becoming more complex. In addition, compared to other industries, the insurance sector is usually more vulnerable to ATA. Individuals and organizations are often a high priority for maintaining insurance coverage, to save risk and potential losses, even in difficult financial situations.

The practice of distributing shareholders is common among insurers. Insurance shares attract income investors to constant income investors. In addition, insurers can change their premiums to reflect inflation and help protect the value of anti -inflation investment.

Global Perspective On U.s. Health Care

Finally, there are legal consequences that can be supporters. Bus and purchases are a common method for industry in the insurance sector. As the business is united as strength and synergy possible, the value of shareholders may be higher. The industry is also a little safer to protect situations, companies and investors.

Despite their strength, the insurance sector has no fall to hold the legacy position. Insurance companies risk natural disasters, major accidents or many conditions. These events can affect a negative way of financial results, especially when unpredictable or black-out events occur.

Because insurers operate in a highly regulated industry, changes in policies, compliance errors or legal issues can lead to financial judgment. It can also cause reputable injuries. An example of insurance regulators can set capital requirements to ensure solvency and stability. An insurer can be forced to prevent dividends from securing enough cash in cash to meet these requirements.

Insurance companies generate income by investing premiums they receive. Profitability resources are available for the effects of interest or poor investment performance. Otherwise, insurers may affect a negative financial condition. Note that companies from the business may not require protection and interrupt the cost.

Arcadia On X: “different Types Of Commercial Insurance You Need To Know. (part-1) To Know More Visit Us

It is an important component to ensure consumer safety, financial stability and ethical practices in the insurance sector. Insurance companies are required to meet the laws and regulations that establish regulatory and government organizations. Here is a summary of the laws that control the insurance sector.

The insurance sector is once

Post Comment