Life Insurance In Usa

Life Insurance In Usa – Understanding how life insurance works and how to buy a police can help you find the best cover to meet your family’s needs.

Life insurance is an alliance between the insurance company and the owner of the police, in which the insured insured is the death of the insured person when the insured person is dead. In return, the insurance tenant pays the insurance company premium during his life. The best life insurance companies have good financial power, very fewer customers, installations, high -faced customs features are available, other rides and simple applications are available.

Life Insurance In Usa

Many types of life insurance are available to complete all types of consumers and preferences. Personal insurance (or family members) depends on the small or long -term requirements of the choice of temporary or permanent life insurance.

Accessibility Commitment From Usa Life Insurance Group, Llc.

Long -term life insurance is designed to walk in a few years and then end. When you take the policy, you choose the word. The General Terms and Conditions are 10, 20 or 30 years. The best shelf life is balanced by affordable qualifications with long -term financial force.

It is precisely the period, which is currently the most common conditions of the conditions, is paying the same amount in the speech of the same police. Other types of time include:

Many long -term life insurance policies allow you to extend the contract every year when it expires, as the reconstruction bonuses are based on your current age, the costs can be increased enough every year. A better solution for permanent coverage is to convert your stubborn policy for the permanent police. This is not an opportunity for long -term policies, so if this function is important to you, contact the poly -compensate policy.

Permanent life insurance is expensive for this time, but it is valid for the whole life of insured persons, unless the insurance tenant goes to the premium. Some policies allow automatic loans when payment of the premium is the maximum amount of payment.

Usa Life & Non-life Insurance Companies

When you buy insurance, you may want to start our best life insurance companies with a list of some of which are below.

In many ways, the Tower Life Insurance is different from constant life insurance, but supports the needs of the best people who meet the needs of many people looking for affordable life insurance coverage. The term life insurance is only for a fixed period and the insurance tenant will die before the end of death. In reality, the opposite of constant life insurance, which is really really, because the insurance tenant pays the premium. Another critical difference is the premium: the life span of this is generally

Before requesting life insurance, you need to analyze your financial position and determine how much money it will need to complete the standard of your beneficiaries or other financial needs. Also consider how long you need to come.

For example, if you are primary care and two to four years, you want to make sure your children can complete you, to be under control, to meet you to meet your children.

This Is The Problem With Life Insurance As A Solution To The Estate Tax Issue

You can find the cost of caring for Nenny and the household or use the cost of using commercial care and cleaning services, and then invest money for education. Add a spouse to your spouse and add requirements for retirement – especially if the spouse deserves many households or parents of the house. These costs will add a little more for more than 16 or currently, and this is the advantage of death if you can afford.

Burdy insurance or final cost is a type of permanent life insurance that has a low death of a small death. Despite his name, the beneficiary can take advantage of death as they want.

Many factors can affect the cost of life insurance premiums. Some things may be out of control, but it is possible to perform the most critical factors before others and age.

When you are approved for an insurance policy if your health improvements require a positive change in life to change the risk class. Although the primary subscription is in poor health, your bonus will increase. If you are in better health, your premium can be reduced. You can also buy additional coverage at the rate lower than this initially.

Benefits Of Life Insurance

What cost was needed to respond to the position of your death. Mortgage, tuition fees, credit cards and other debts and other debts and other debts that are not mentioned. In addition, change in income is an important factor if your spouse or your beloved will need cash flow and will not be able to provide it on its own.

Help accessories are online to calculate the amount that can meet all the potential costs that will need to be covered.

Life insurance requirements generally require a personal and family medical history and information about beneficiaries. You may need to undergo a medical examination and you will need to disclose all hasty medical conditions with violations of history, back and fall (such as motor racing or parachute). The following elements are important elements of most life insurance requirements:

Before writing, a policy such as your social security card, driving license or past.

Overview — Nicholas Hill Group

When collecting all the necessary information, you can collect several life insurance offers from different suppliers in accordance with the survey. Prices can come from a business company to a business, it is important to try to find the best combination of premium policy and cost. Because the life insurance premium will pay for a month for a decade and seek a police that meet your needs that are very good for your needs.

Our offer of the best life insurance companies can start your search. Make a list of companies that we have found the best for different types of needs according to our survey of about 100 carriers.

There are many advantages to obtain life insurance. Below you will find some of the most important features and security represented by life insurance policies.

Most people use life insurance to provide money to beneficiaries who will be financial hunt for the death of insured persons. However, for the rich benefits of life insurance services, they can offer additional strategic opportunities, especially cash values and existing benefits and tax franchise.

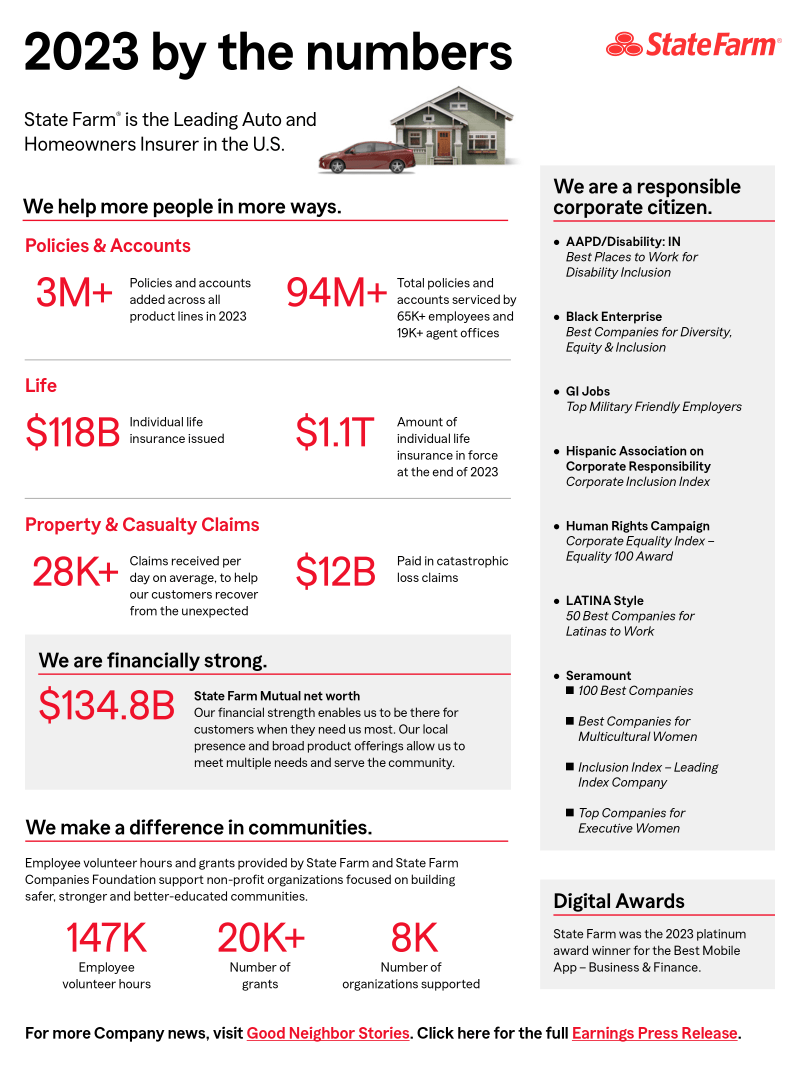

State Farm® Announces 2023 Financial Results

The benefit of the insurance police is generally in the tax franchise. This can be the subject of tax tax, but rich sometimes trust permanent life insurance with confidence. Confidence helps them to avoid inheritance taxes and save the value of their heirs.

Avoiding tax is a reduction in the law to reduce your tax liability and should not be replaced by a tax evasion that is illegal.

Life insurance provides financial assistance to avoid life insurance or other beneficiaries after the death of the support holder. There are examples of people who may need life insurance:

Each font is unique for the insured person and the insurance company. It is important to review your policy document so that your policy understands how much your beneficiaries will pay for your beneficiaries and who are the circumstances.

Pack Of 100 Certificates

Since life insurance shelves are the main costs and commitment, it is important that you are working hard to ensure that the company you choose is a solid and financial force. In case of stability in case of stability that cannot gain the death of himself for the future. They have evaluated a number of companies that offer all different types of insurance and have rated the best in many categories.

Life insurance may be to provide your bets and ensure the security of your loved ones to ensure the security of your loved ones. However, in situations where it makes less sense – because you buy too much or protect people who do not need to change. Therefore, it is important that you consider many factors before the decision.

What cost could not be fulfilled if you die? If your spouse has a high income and you have no children, you cannot be guaranteed. It is always important to take into account the effect of your potential death and consider how financial help return to work before they are ready. However, if the desired lifestyle or response to financial wedsit requires two courage revenue, the spouse may need a separate life insurance coverage.

If you buy a policy from another family member, it is important to ask: try to protect? There is no significant income to replace children and alumni, but the cost of burial may be required

Post Comment