Insurance Broker Usa

Insurance Broker Usa – The insurance report is divided by insurance (life insurance and property insurance and accident insurance), a kind of intermediary (retailer intervention and wholesale transmission) and regions (North America, Asia -Positive, Europe, South America and the Middle East. Africa). The report provides market size and predictions to the Value Insurance Market (USD) for all the above categories.

Market Size and Market Market Growth Compare with other financial services markets and investment intelligence industry

Insurance Broker Usa

The size of the insurance broker market is estimated to be 1 331.96 billion by 2025, and by 2030, it is expected to reach US $ 3.56% from US $ 395.41 billion in an estimated period (2025- 2030).

Gnp Brokerage Us Inc.

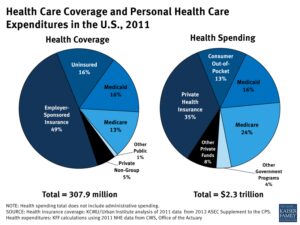

Insurance broker deals with customers to understand their needs and negotiate with the insurance company on behalf of the customer. Insurance broker includes individuals or companies working on behalf of their client. Insurance intervention includes 80% insurance operations in many areas of the world. The epidemic adversely affected the growth of the worldwide market market. Infectious disease urged the insurance broker to respond to changes in trends, which is a major digitization of its customer communications. The insurance broker’s market has been stimulated by a continuous increase in union and acquisition.

The insurance sector should increase the demand for policy insurance during the proposed period. The demand and awareness of insurance policies in people is increasing every day, which is an important factor for the growth of the insurance broker market. The marketing market has experienced the development of life insurance, car insurance and property insurance policies. The increase in this demand has led to an increase in awareness between consumers and the importance and benefits of insurance policies. Considering the increasing awareness and demand of policy insurance in real estate and accidents and life insurance, the market should increase in the stipulated time. Considering the importance of broker, digitization and technology integration in insurance, they can also affect delivery paths. This impact enhances insurance intervention market growth.

Life insurance is a rapidly growing division from the genre of insurance. Increasing awareness and personalized opportunities in the field of life insurance are attracted to the purchase of life insurance. Insurance digitization and other sectors are growing due to several factors that increase AI acceptance. The insurance company depends on the human agents, but due to the company’s epidemic, they were unable to physically visit the customer. Insurance companies have launched digital platforms that change customer communication and business mode. Life insurance is also essential in today’s world. Pacific Asian and North America have increased life insurance requirements.

China has a population of 1.4 billion in the Asia-Pacific region, followed by India, Indonesia and Pakistan; It encourages insurance companies to focus on these countries and expand their network. Low life insurance penetration is expected in these countries with a higher population to bring more demand for insurance. Most combinations and acquisitions have helped to increase the worldwide market. Union and acquisition activities have increased in recent years. Insurance Broker and Insurance Company was beneficial for fusions and acquisition activity because it helps capture a high market share.

What Is A Wholesale Insurance Broker?

The insurance broker market is moderately mented, with the presence of many players. Gives market growth opportunities in the stipulated time, which further promotes competition in the market. The competitive province shows all the tactics, such as acquisitions and meetings implemented by players to have the largest market share around the world. Some participants who participated in the market are Akraiser LLC, AON PLC, Brown and Brown Inc, Arthur J Gallaghar & Co and Marsh & McLenon Companies Inc.

Insurance Broker is a person who works for a consumer for sale and negotiating various insurance products. The report includes a detailed note on the importance of insurance brokers in various insurance products. Insurance Broker Market Insurance Types (Life Insurance and Property and Accident Insurance), a type of broker (retail and wholesale mediation) and regions (North America, Asia -Pasific, Europe, America, South and Middle East and Africa and Africa). The report provides market size and predictions to the Value Insurance Market (USD) for all the above categories.

The size of the insurance broker market is expected to reach 1 331.96 billion by 2025 and by 2030 the CAGR’s 3.56%, which reaches US $ 395.41 billion.

Akraisur LLC, AON PLC, Brown & Brown Inc, Arthur J Gallaghar & Co and Marsh and McLenon Inc. are the leading companies in the Insurance Market.

Axa Global Healthcare Insurance Plans

By 2024, the size of the insurance broker market is estimated to be US $ 320.14 billion. The report includes the size of the historic market for years: 2020, 2021, 2022, 2023 and 2024. The report published the size of the insurance broker market in the years: 2025, 2027, 2028, 2029 and 2030.

Insurance Stamp Marketing Participation Statistics of 2025, the size and growth rate of revenue from Mordra Intelligence ™ reports. Insurance Broker Analysis includes a market forecast and historical review from 2025 to 2030. Get a model of this industrial analysis as a free PDF transfer report.

Mordore’s intelligence images can only be used by accusing Mordore’s wisdom. Using the Incorporated Biting Code of Intelligence, it displays the image by issuing a line that meets this request.

Also, using the -In -inter -created code, reduce your load on your web server because the image hosts the same global network for the issue of content using Mordore Intelligence instead of your web server. We are always a flexible industry. There, people always need insurance, ”Catherine Pipitone’s turbulent words, executive vice president and senior operation manager in the Alliance insurance services.

The Best Insurance Brokers Near Me ( Updated )

Hot 100 2025, which identifies major leaders and movements and movements, their offers have helped to form insurance in the last 12 months.

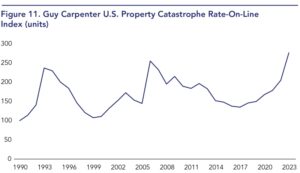

The American industry has brought an influential transaction in financial performance, showing Ineloit’s 2025 global insurance prediction.

The second Hot 100, Deborah Diogardi, National Leader Zencap -A, connects to the basics of strong competition to return to the basics of strong competition.

“This is a soft market for professional responsibility and there is a lot of capacity. Many happy people, many carriers we are dealing with. It’s not an easy market for us, but we grow,” he says.

Cdi Global Italy Advises Wide Group Spa On Acquisition Of Alliance Risk And Insurance Broker Spa, News / Insights

And Diogardi, who played his role in March 2023, continues to be: “I’m proud of how hard everyone works in the growth team. We are originally a new company, which is great in this market for current professional routes. Successful with them.

The US has the largest nominal value in the world and is expected to rise to 3.49 % per year, which will reach the market by 2029 to 50 4.50.

“We are too independent. If we don’t save money on our customers, we have nothing to do and we will always focus on there.”

TN’s Noxville -based Captures Sachura, as president of the Sachura, finds ways to endanger consumers and transactions, in which their inmates serve as a reinforcement. For example, if they do not want to maintain all responsibility, it will help customers find other reinsurance to keep as much money as possible in their own insurance companies.

State Farm Insurance Hi-res Stock Photography And Images

“All of our business model is focused on getting more money from awards to their own captivity insurance company. So we are more successful. They become our customers and then perform their own risks,” says Regnick.

The Bulls also had a keyboard solution in the captivity, the first open distribution. It is intended for customers, especially real estate and more awards, but have not many rights – and they are well received.

“People from the last 12 to 18 months may be in their lodgings or in an exposure to wild fire, with no need to cover the general liability or insurance market assets, and try to keep all their costs as little as possible,” says Regnik.

Similarly, he is pleased with the year in 2024, Jeff Rodriguez, President and CEO of Brown & Riding, one of the largest private property owners owned by a fully independent private property. However, they did not expect it to be.

10 Largest Auto Insurance Companies (february 2025)

Rodriguez says: “If you see reports of winning all public brokers, where you can see the growth and the narrowing of the environmental gains. I think it is more than this year. I didn’t think ‘t

Post Comment