Insurance Usa Medical

Insurance Usa Medical – One of the most common issues that are independent management advisers is how to get health insurance as independent, independent advisors and small businesses in the United States.

The short answer to obtain health insurance in the United States as an independent professional depends on whether you are the only owner or have employees with two main access options:

Insurance Usa Medical

Here we break it, as well as distribute special guidelines for possible routes to receive medical care as an independent advisor, as well as catalogs of real insurance plans (state) and mediators who use participants.

Health Insurance For International Students In The United States

If you know about insurance companies or intermediaries we haven’t provided or would like to share with us updated information about one of the companies in our catalog, send us a message on our side contact.

In the study conducted with independent management advice for more than 160 experts from the United States, they shared their experience in obtaining health insurance.

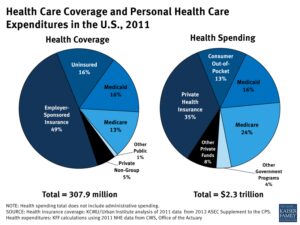

Most respondents in the research have health insurance through spouses (29%), and the second most common option is the insurance that has received on the ACA Healthcare market (21%).

In addition to these two routes, advisors have received their own insurance policies or directly from the carrier or over the broker.

1 In 4 Adults Had Insurance But Still Couldn’t Afford Medical Care

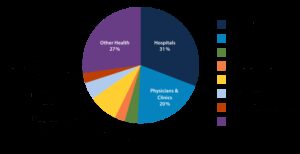

Most of the respondents in our study have health insurance with a small group of suppliers, and mainly consists of:

Almost two-Pordi independent advisors choose the desired organization of suppliers (PPOs), with 15% with the organization for the Health Service (HMO).

More than two respondents have a plan that covers more persons: 44% have a family plan, and 25% have a coating for oneself and spouse or partner or partner. 32% have an individual plan.

Approximately half of our independent advisors have high medical care. HDHP has a larger annual franchise and maximum limitations within the pockets of traditional plans. The monthly bonus is usually lower, but paying more health care costs before the insurance company starts paying for your share (your franchise).

Is Healthcare Free In The Usa For Foreigners?

The high plan of the franchise (HDHP) can be combined with health care savings (HSA), which allows you to pay certain medical costs with money without federal taxes.

With the help of HDHP, the annual franchise should be performed before the fees are paid for services for services, except for preventive help services in the network that are fully covered.

HDHP is divided into catastrophic protection costs on a sheet metal pocket for covered services. After the annual costs for confiscated pockets for covered online suppliers, including franchises, adoption and joint insurance, achieving a predetermined catastrophic restriction, pay 100% the amount allowed for the remaining part of the calendar year.

Frank Leisi says: “Because my family, in good condition, I chose a low price plan with a great amount. When my wife and I become older, and my children can move on to a lower franchise plan.

National Health Insurance Programs In The United States

To get additional information about high medical services, HSA and Hu (such as many other insurance conditions), check this glow that provides Healthcare.gov.

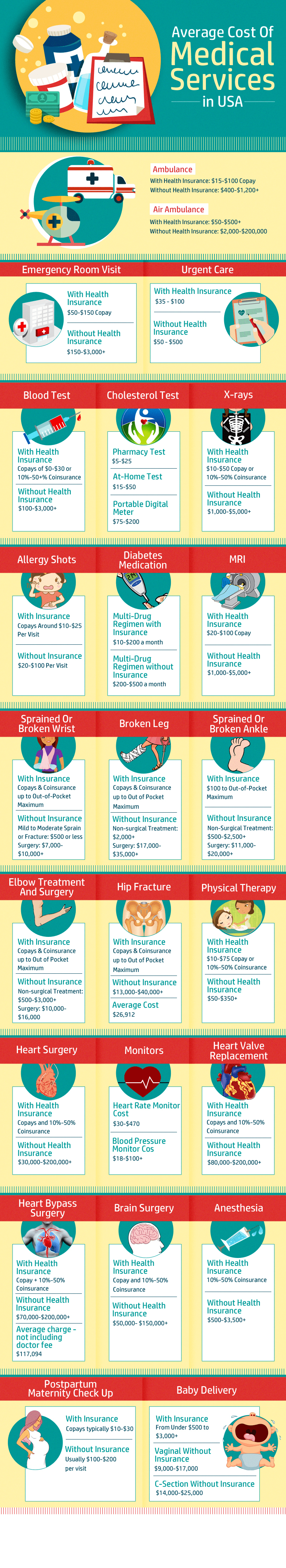

When it comes to costs, there is a wide range of monthly bonuses that differ depending on several factors:

Then let’s look at the specifics that are health plans available to independent advisors and about different options that you can get for the best insurance for your needs.

If you are the sole owner, you are a legally department and, so you do not have the right to a business insurance plan. For those independent experts working as the sole owner or LLC, without employees with W2, which begin with the market of the Law on an Isless Medical Care, as a rule the best step.

A Comprehensive Guide To Healthcare For Expats In The Usa

The Law on Protection of Patients and the available Medical Service, called an affordable medical services or “ACA”, is the Law on Health Reform, adopted in March 2010. years. You can start a search for a medical coating in your health care.

If there are no separate state websites for your ACA market, you will simply transfer the federal page to HealthCare.gov to get quotes and potential plans. Note that ACA insurance can only be obtained during the open registration period. This is the only time of the year when you can buy or adjust the health insurance plan for the next year. This year window 1. November 2021. 15. January 2022. If you miss you, you will have to wait until next year.

You can also contact your insurance operators in your staff to buy them direct insurance, says Molly lid, Vice President Brown & Brown from New York.

“This is really the only option for a person today,” says the lids, or the ACA market, either directly from the insurance company.

A Giant Trash Fire’: Woman Breaks Down Scary Costs Of U.s. Health Insurance

An article researched by insurance companies directly studied insurfator reviews and investigated which includes their current doctors and dentists in the network.

Once you have a company, ie you have at least one W2 employee, except alone, then you can get a business security plan for work.

The cover notes that it is considered a full employee, the federal leadership means that a person works at least 30 hours per week. “Some insurance bearers will allow you to offer covers 20 hours per week, but the Federal Management is 30.”

Although the group plan is quite consistent in all 50 countries – the best number of employees belonging to a small group, depending on staff.

Health Insurance For International Students In The Usa

“A small group is considered a company of 100 employees in New York,” Leeds explain. “In New Jersey, a small group is defined as a company with up to 50 employees.”

Some insurance carriers require at least one W2 employee completely, regardless of your property or partnership. In other words, for these LLC carriers or partnerships with several independent experts – but without employees – will not be qualified.

The covers say it depends only on the leading insurance principles for each carrier. “But there are many options for small groups, therefore,, as a rule, our customers will not be too hard to find, even if one operator does not allow their specific type of configuration. There is another one to be.

He also warns one situation in which several partners or employees in the company will not qualify.

Choiceamerica And Inbound Usa Insurance

“The only situation that can prevent the two owners of the company or owners and employees in a marriage couple. So if it should, if it should, they will need a third party to them a third party in the company. That would really do. “

One employee advisor has provided group health insurance for himself and his team for several years.

“We offer h, they were crazy and wanted 4x of our expenses for the second year, so we started it with a blue cross shield, and now everyone is really happy with your coverage – even I thought it was expensive,” he said that is that expensive.

To get a business insurance plan, you usually have to file certain documents that establish your business, such as:

International Healthcare As A Nomad

“If you have several full employees, group insurance would be in a way,” says one advisor.

Other reports to plan to convert its 1099 performers to W2 employees and apply for a group full performance for the company next year.

Although the covers are advised, starting from the federal health exchange or state-exchanged in accordance with the Law on Accessible Medical Care, it is generally the best place for independent health insurance professionals, they can expand in the study of small groups for the group and compare the group and compare With the view that is most appropriate for their needs.

He explains that there is a slightly large difference between the ACA plan and the private plan of small groups.

Usa Health Insurance

“One of the great differences can be a network. The standard bracket in New York, whether it is Oxford or Blue Cross or coat of arms will have a network for its group plans – there is a group of group plans. There may be more doctors in compared to the special network of exchange plans. I would say this is one of the great differences. “

You usually have easier use when you have a group plan – instead of calling an individual insurance plan and you can call or jump through HealthCare.gov and the Website of the Carrier – Respecting a small group of groups all kept together and usually more convenient to manage.

Costs may also vary, because the individual tariffs of the exchange plan is based on the place where they live, while the prices of the Group is based on where your company finds your company. It is often the same, but not always. The covers say that there are other variables, depending on where the company is based.

On group plans, depending on location, previously existing terms and factors such as

Post Comment